The potential for $1.5 trillion to be wiped of house prices – What’s the opportunity & solution?

Fintor relies heavily on the opinions and research of highly respected Australian and Global investment managers. One of these managers is Coolabah Capital who operate the Smarter Money Long/Short credit fund held within all Fintor portfolios with a defensive component. Christopher Joye, the portfolio manager at Coolabah Capital Investments consistently has some great insights into the broader macro-economics impacting everyday Australians.

Christopher Joye shared recent insights into the RBA decision to raise the cash rate, what the future holds and what can be expected. Christopher writes that the RBA has a long history of getting the Aussie housing market’s reactions to its cash rate changes horribly wrong which is surprising given how easy the housing cycle is to forecast. Crucially for investors this interest rate cycle will be heavily influenced by the direction of Aussie house prices, which have never been more inflated after years of cheap money.

Christopher believes that this will be accentuated by two facts:

- Cheap fixed-rate loans numbering in the hundreds of billions of dollars will transition to much more costly variable rate products in the next 2 years. This will undoubtedly amplify the impact of the RBA’s hikes.

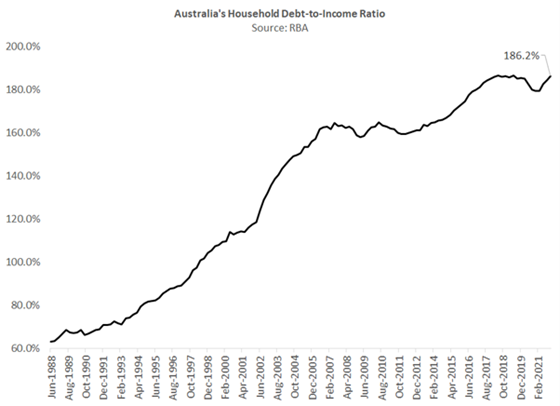

- Households are generally much more sensitive to interest rate changes than they have ever been before. Specifically, Australia’s household debt-to-income ratio is sitting around 186%, in line with its all-time highs.

From this perspective Fintor agrees, as many clients have become used to very cheap interest rates and lowered loan repayments. Sadly, many families have increased their expenditure or have been unable to save due to the Covid-19 impacts. This is particularly the case with many of our small business clients. Fintor is actively engaging clients to take a deeper look into their current spending with the goal of prioritising lifestyle chooses and seeking to create additional surplus in order to afford what could be a 20-50% increase the standard principle and interest home loan repayments should the RBA raise rates by 1.00% – 1.50%.

Where could interest rates end up?

The good news is that the anticipated continuation in RBA rate rises does have an end point. Christopher Joye projects that the RBA will likely be forced–if it acts prudently–to pause its monetary policy tightening process after the first 100-150bps of cash rate hikes. Christopher also shares the view of Fintor that the banks are likely to pass on more in the form of even larger mortgage rate increase as a result of the commencement of a record 15% to 25% decline in Aussie home values. Coolabah capital and Christopher Joye forecasted these events way back in October of 2021.

How could $1.5 Trillion be wiped from Australian Property Values?

The total value of residential real estate in Australia is currently worth $9.9 trillion according to Australian Bureau of Statistics (ABS) data. Using complex modelling, countless economists and managers, including Christopher Joye have forecast a property decline between 15% to 25.00% based on RBA rate rises and several other economic factors. Assuming the RBA reaches its targeted rate rise of over 100 to 150 basis points (1% – 1.5%) over the next 12 to 18 months and the lower end of the economists’ predictions at a 15% decline. This series of events has the potential to inflict losses on households worth some $1.5 trillion assuming just a 15% draw-down in national home values. It is important to understand that this is the lower end of Christopher Joye’s and many other economists expected range.

Another Hurdle To Over come

Australian Banks funding costs are soaring as evidenced by the current Fixed-Loan interest rates on offer by many well respected Australian banks. Only six months ago Fintor’s mortgage broking team was able to offer clients sub 2.00% rates on 2- & 3-year loans with a Loan-to-Value Ratio (LVR) of under 80%. Presently these rates have increased with most lenders potentially offering interest rates north of 3% or even as high as 4.50% on 2 year fixed rates and above. What is not yet known is how the banks will react to further increases in their cost of funding and the potential for further out-of-cycle rate hikes. There is potential for rates to go even higher!

It gets more alarming

Australian have not seen a genuine recession since the early 90’s ok there was a brief “technical recession”, but nothing like what the globe has seen or what Australian has experienced in the 1980s & 90’s. In fact Australia holds the record for the longest running economy without a recession which has been absolutely fantastic for any homeowner further amplifying the mantra of “property always goes up”.

Unfortunately, this has caused Australians to become complacent about the risks associated with large amounts of debt and sadly these risks are likely to become realised by those who have borrowed beyond their means in order to get into an overpriced property market as evidenced by the RBA’s Household Debt to Income Ratio graph below

)

Why Fintor places trust in Christopher Joye’s & Coolabah Capital’s analysis.

Simply put they’re one a few managers openly sharing their forecasts and their team have thus far been very accurate. Here is Christopher and the Coolabah’s Capitals previously stated economic forecasts which have been incredibly accurate.

In 2013, Christopher and Coolabah Capital repeatedly warned the RBA–publicly and privately–that by slashing its cash rate it would precipitate the mother of all housing bubbles, powered by double-digit house price appreciation. Between 2011 and 2017 the RBA slashed the cash rate from 4.75% to 1.50%. Over this time, national prices soared an amazing 41% based on CoreLogic’s all regions index, which includes both the capital city and regional markets (or by 48% using the 8 capital city index that excludes regions).

The Coolabah Capital team further advised the RBA in 2013 that they would be forced to embrace the application of macro-prudential constraints on credit creation, which it was–at the time–opposed to. By late 2014, APRA had been compelled to slowly start introducing these measures, which were progressively ramped-up in the years that followed.

Between 2015 and 2017 APRA’s limits on credit creation forced lenders to materially hike interest rates on investment property loans. In early 2017 we argued that this would result in a 10% decline in national house prices. Between 2017 and 2019 the 8 capital city index price slumped 10.2% (the all regions index fell about 8.3%). While not much was happening in the economy, it was the biggest fall in house prices since the early 1980s.

In mid 2019 Coolabah Capital forecast that future RBA rate cuts would drive house prices up 10% over the next 12 months, which is what we got: the 8 capital city index rose 10.3% while the all-regions index climbed 8.9%. This seemed to come as a surprise to pretty much everybody.

In March 2020, Coolabah Capital projected a very short, and shallow, correction of 0% to 5% followed by capital gains of up to 20%, starting in September 2020. CoreLogic’s all regions price index fell 2.1% between March and September 2020 (the 8 capital city index declined by 2.8%), and thereafter started climbing quickly again.

The RBA claimed that there would not be a housing boom in response to its pandemic policies because population growth was non-existent. However, Coolabah Capital countered that the profound change in purchasing power care of a huge reduction in the cost of debt coupled with robust income growth would power a sharp, 20% increase in prices. By October 2021 the All Regions Dwelling Value Index had indeed increased by 20% (8 capital city prices were up 19.5%).

In that month Coolabah Capital again controversially updated their forecasts to include at least another 5% of national price growth until the RBA started increasing its cash rate in the second half of 2022. Unfortunately, Coolabah Capital was a couple of months off on this prediction (however only by 2 months!).

Coolabah’s forecast of a record housing downturn

Colabah Capital forecast that national home values would then correct by 15%-25% after the first 100 basis points (bps) (1%) of RBA cash rate increases representing a record draw-down in Aussie households’ most valuable asset: their property.

Since Coolabah Capital’s October 2021 forecast was released most bank economists have subsequently embraced the proposition, typically projecting a circa 10% correction in Aussie house prices over the 2022 to 2024 period.

It’s not all bad news!

The Australian housing market has appreciated significantly since 2019 and you need to put the potential decrease in property values in context. Since 2019 home values across all markets have appreciated by 37% since mid 2019 when the RBA first started cutting its cash rate. Therefore a 25.00% decline in values ( $2.47 Trillion) would likely see house prices return to 2019 to 2020 values.

The news gets better

Coolabah Capital predict that the RBA is likely to remain steadfast in their decision to steadily increase rates, but to an extent. Their prediction is that the RBA is unlikely to continue monetary tightening once Australian home values realise a 10% decrease in value, which is reason for their prediction of a 15.00% downturn

So where is the opportunity?

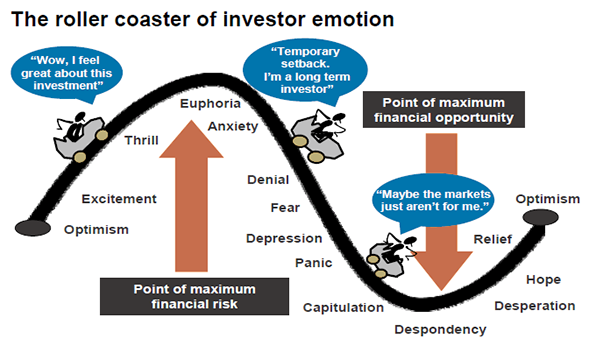

The old saying rings true, “buy low, sell high”. Fintor has summarised Coolabah Capital’s Findings not to alarm you but to focus your attention on the reality at hand and to minimise anxiety through knowledge. Knowing the situation at hand, we can then start to focus on implementing solutions to allow you to prosper in this new environment. A picture says a thousand words and AMP Capital’s illustration of the normal behaviour experienced in different market cycles is a great representation.

What Fintor wants everyone to avoid is the “fight or flight” response. Most Australians seeing losses of hundreds of thousands of dollars will choose “flight” in order to exit the market to cease further losses. This is evident in every share market correction since the 1980s and fortunately this hasn’t transferred onto the property market (yet). It’s important to remember that Australians haven’t really seen a property market correction since the late 80’s so we want to take a proactive response to the impending issue. By understanding the normal emotions you will experience during this downturn our hope is that you are then able to make sound choices and rationalise your investment decisions. The most profitable reaction would be to completely inverse the illustration above.

So what are the solutions you can consider?

This will depend highly on you own situation and financial position. For those of you who have recently purchased and don’t have the equity in their property, Fintor suggests you consider starting pretending your loan repayment is 1% or 2% higher than it currently is to learn how to budget in a new higher interest rate world. Additionally you could credit the surplus payments into either a savings account or better still an offset account. Fintor would caution you against placing the additional money into your home loan directly as your bank may restrict access to redraw during a downturn which is unlikely but still possible. For help and analysis on what your loan repayment would look like please speak to Fintor’s advisers or access our loan repayment calculator tool here.

For those with equity in their property and an appetite for calculated risk Fintor suggest seeking the advice of a mortgage broker to consider obtaining additional funding (loans) to a safe borrowing capacity. Remember this will be based on your personal circumstances and goals so it’s imperative to obtain personal advice before proceeding. That being said having the additional capacity to borrow (fire power) will help facilitate you to purchase properties which are subject to a “mortgagee sale” or are under distress. Our thoughts are that some properties could experience greater than a 25.00% decline in value and at that point there could be considerable opportunity to make money. It is important to organise funding sooner rather than later as your ability to borrow will be significantly lowered in a high interest rate environment. This is because banks assess your ability to borrow at the current interest rate plus 3.00%. For example at a 4.5% interest rate you’d need to be able to service a 7.5% loan. Currently you only need to have capacity to service a 5.5%-6.00% loan depending on the interest rate.

Remember to always seek personal advice from trusted and qualified professionals before engaging in any of the strategies highlighted above. It is also important to note that you should not jump on any or the first opportunity presented as it must be appropriate for your personal circumstances and goals. Be calculated, seek advice and above all else don’t put yourself in a situation that will create financial hardship. This is where Fintor’s team of financial advisers, mortgage brokers and accountants shine!

To discuss your particular circumstances in further detail and to explore the strategies and opportunities Fintor can use to help you consider the opportunities and solutions discussed, please contact us.

1300 FINTOR or yourfinancialmentor@mix.fintor.com.au

Recent Comments