Professional Financial Guidance & SupportReimagined

Fintor offers a dynamic fusion of cutting-edge technology and expert guidance, tailored to enhance your unique financial journey.

User-friendly, adaptable, and exceptionally cost-effective.

Choose Your Ongoing Experience

Select the experience that best matches your current needs and future financial aspirations. Whether you’re looking for continuous support or a one-time tailored solution, Fintor has an option designed specifically for you.

Ongoing Support

Ready | Set | Go

A dedicated team of qualified financial professionals that is continuously committed to helping you achieve.

On Demand Support

A tailored experience delivered where & when you are most comfortable. Ideal for those looking for standalone recommendations without ongoing commitments.

Ready Set Go!

All memberships include free access to Fintor’s wealth portal and Education platform, where you can access free and premium financial education & tools!

Ready

Professional Administration- Live Financial Dashboard

- Personalised Report Suite

- Document Storage Vault

- Phone-Based & Live Chat Access

- Regular Ongoing Client Support*

- Regular Ongoing Coaching OR Financial Advice*

- * Additional costs apply

Set

Financial Coaching- Everything in Ready

- Dedicated Financial Coach

- 3 Quarterly Accountability Meetings

- Annual Optimisation Review Meeting

- Phone-Based Coaching Support*

- Coaching To Optimise Your Strategy

- Access To Client Support Team*

- Access to comprehensive advice strategies not included

- Trust & Entity (Pty Ltd) based advice not included

Go

Ongoing Financial Advice- Everything in Ready

- Dedicated Financial Adviser

- 3 Quarterly Accountability Meetings

- Annual Optimisation Review

- Phone-Based Adviser Support

- Advice To Optimise Your Strategy

- Ongoing Management of Comprehensive Financial Strategies

- Unlimited Access To Client Support Team

- Trust & Business Entities Not Included

Need More Information

Fintor does more, for less.

You're in control

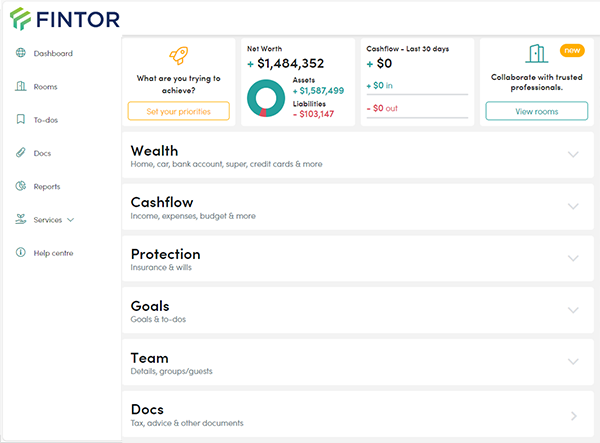

One View Wealth Portal

Understanding where you sit financially doesn’t need to be a nightmare. With our Real View wealth portal, you can quickly view how you are progressing towards your targets without the help of a professional.

Easy to setup

Live Updates*

Detailed Reporting

*Live updates are only available to subscription holders.

We have been working with Lucas and the team at Fintor for a several years now and have been steadily building a strong, diverse portfolio of investments to secure our financial future.

Collaborate, Update, Review and more

Transparent & Helpful

Fintor provides complete transparency, allowing you to see all the efforts our team is making on your behalf. Stay informed and track the progress of the strategies we implement for you.”

Know Your Team

Document Portal

Transparent File Notes

My wife & I have been with Lucas Smithers our financial mentor for the past 4 years. Lucas is very passionate & professional in what he does. We are slowly meeting our goals & we are grateful for he’s patience & guidance. I highly recommend Lucas & he’s team to family & friends.

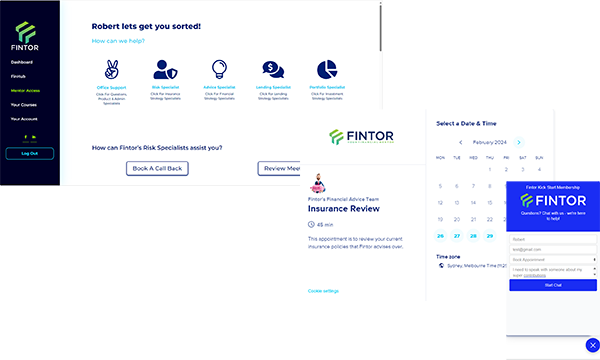

Helpful guidance, when and where you need it

Access Professional Guidance

The day you need help just got less stressful thanks to Fintor’s support and adviser access.

Live chat

Live calendar links

Phone, Teams, Zoom & Office

Lucas has been helping my husband for 20 plus years and myself 15 plus years, I did not make it easy for Lucas when I came across from my previous super and I still can not believe what he has done for us.

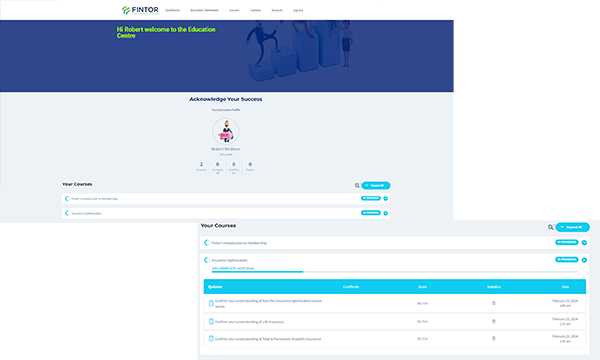

Understand what is possible

24/7 Knowledge Centre

We equip you with step-by-step training and industry-leading knowledge, empowering you to take control and confidently progress on your financial journey.

Education Dashboard

Tools & Calculators

Serious Advice Discounts

Professional Advice & Strategy Options & Inclusions

| Financial Coach (Set) | Adviser (Go) | Advice Specialist | |

| Program Availability - eligable persons/ entities | |||

| Single or couple |

|

|

|

| Trusts / Self-Managed Super's / Pty Ltd | Ongoing Support Only |

|

|

| Cashflow Management Strategies | |||

| Banking Structure & Optimisation |

|

|

|

| Basic Budget & Automation |

|

|

|

| Lending Structure & Consolidation |

|

|

|

| Personal Lending & Repayment Strategy |

|

|

|

| Investment Lending & Repayment Strategy |

|

|

|

| Centrelink & Family Assistance Benefits |

|

|

|

| Wealth Protection Strategies | |||

| Cash Reserve & Liquidity Strategy |

|

|

|

| Basic Planning & Protection Advice |

|

|

|

| Basic Insurance Needs Analysis |

|

|

|

| Insurance Product Advice | Ongoing Support Only | Ongoing Support Only |

|

| Comprehensive Insurance Needs Analysis |

|

|

|

| Business Needs Analysis (Buy/Sell) | Ongoing Support Only |

|

|

| Comprehensive Planning & Protection Advice | Ongoing Support Only |

|

|

| Wealth Creation Strategies | |||

| Basic Tax Optimisation Strategies | Ongoing Support Only |

|

|

| Investment Risk appetite & profiling |

|

|

|

| Super Risk appetite & profiling |

|

|

|

| Investment product advice | Ongoing Support Only |

|

|

| Investment contribution strategy |

|

|

|

| Superannuation product advice | Ongoing Support Only |

|

|

| Superannuation contribution strategy |

|

|

|

| Superannuation estate planning |

|

|

|

| Outsourced Investment Solutions |

|

|

|

| Tailored Investment Solutions |

|

|

|

| Retirement Planning Strategies | |||

| Retirement planning Advice | Ongoing Support Only |

|

|

| Transition to retirement advice | Ongoing Support Only |

|

|

| Centrelink Advice | Ongoing Support Only |

|

|

| Aged Care Advice |

|

|

|

| Specialist Financial Advice - As Required | |||

| Comprehensive Tax Optimisation Strategies | Ongoing Support Only |

|

|

| Ownership Optimisation Advice | Ongoing Support Only |

|

|

| Property Portfolio Strategies | Ongoing Support Only |

|

|

| Borrowing to invest (gearing) | Ongoing Support Only |

|

|

| Debt Recycling | Ongoing Support Only |

|

|

| Self-Managed Superannuation (SMSF) | Ongoing Support Only |

|

|

| SMSF Borrowing | Ongoing Support Only |

|

|

| Buying Property in Super | Ongoing Support Only |

|

|

| Business Growth Strategies |

|

||

| Business Retirement Advice |

|

||

Membership Support Inclusions

| Ready | Set | Go | |

|---|---|---|---|

| Dedication Professional Support | |||

| Financial Coach |

|

||

| Qualified Adviser |

|

||

| Financial Dashboard | |||

| Live Data Tracking | Daily | Daily | Daily |

| Document Storage |

|

|

|

| Personalised Reporting & Tracking | |||

| Cashflow Report |

|

|

|

| Budget Report |

|

|

|

| Net Wealth Report |

|

|

|

| Goals & Objectives Tracker |

|

|

|

| Tax Deduction Report |

|

|

|

| Entity/ Business Reporting |

|

||

| Professional Support Access | |||

| Live Chat |

|

|

|

| Client Services |

|

|

|

| Lending Specialists |

|

|

|

| Insurance Specialists |

|

|

|

| Investment Specialists |

|

||

| Advice Specialists |

|

||

| Professional Services Inclusions | |||

| Client Services Support | 4 Hours | 10 Hours | Included |

| Quarterly Check In | Coach | Adviser | |

| Annual Strategic Review | Coach | Adviser | |

| *The above-stated time limits are reset annually at the start of each financial year. Should these limits be exceeded, additional fees will apply. A representative from Fintor will notify you in advance of any extra charges. Furthermore, fees for Reviews and Strategic Advice will be separately detailed in a Letter of Engagement, provided formal advice is deemed necessary. | |||

| Personal Advice Discounts | |||

| Review Fee | 0.00% | 50.00% | Included |

| Strategic Advice Fee | 10.00% | 20.00% | 30.00% |

Advice When You Need It

All of Fintor’s continuous coaching programs incorporate our Interact Subscription. The Professional Advice service, however, is tailored for specific, singular events requiring advice and, as such, does not encompass the Interact Subscription.

Professional Advice

Seeking professional assistance for efficient and beneficial financial guidance?

Fintor’s professional advice service is your solution for tailored advice matching your unique financial situation.

Our financial experts offer quick, effective counsel without long-term commitments. From investments to retirement savings or general financial management, we’re here to help.

Take charge of your finances with our personalised service.

Experience the difference today!

On Demand Professional Advice

Client Support Team – $185 per hour

Financial Coaching – $249 per hour

Financial Adviser – $325 per hour

Advice Specialist – $399 per hour

Pay as you need advice fees

No ongoing fee commitment

Specialist financial strategies available

Advise over Multiple entities

Transparent Pricing

Fintor’s financial advice team is driven by a passion for our clients’ success.

Before your initial onboarding, our highly skilled team conducts extensive market research and product analysis, ensuring we offer personalized and efficient advice. Much of our effort, about 80%, happens behind the scenes, where we diligently work to provide top-notch recommendations and support.

To maintain competitive fees while dedicating ample resources to each client, we implement a fair charging structure.

Free & Premium Financial Courses

Interact

Investment Portfolio's

Research & Opportunities

Frequently Asked Questions

Which courses are free?

Currently, Fintor provides three free comprehensive financial education courses including; Insurance Optimisation, Super Optimisation and Budget Optimisation. Fintor plans to expand it free education offering in time.

Why does Fintor provide free courses?

Fintor makes money from advising Australian’s from all walks of life. To engage, excite and inform Australians of the life changing benefits Financial Advice can deliver, Fintor is happy to give insight and guidance into the process financial advice takes to uncover your potential. Once you’ve completed your first course Fintor is confident you will continue with our engaging education to better your financial future!

Why does Fintor provide over a 40% discount on advice fees for people who complete a financial course?

Each course informs, educates and asks the attendee to research and analyse their own situation. This process allows Fintor to significantly reduce the time it spends gathering information, explaining strategies, features and concepts. With an informed and engaged customer our advice process becomes efficient which reduces time spent & the overall cost to you. It’s a process designed to help you save… Basically what a financial team should be doing!

Why is your education content so cheap compared to Fintor’s advice fee?

Fintor financial education platform is designed to compliment Fintor’s advice process through members gaining the knowledge they seek and a heightened understanding of the advice topics & strategies their adviser may discuss. At no point does any lesson provide advice.

How does Fintor use my information?

Fintor is able to see the basic information entered into the form at sign up. Any information provided to Fintor is held with the strictest of confidence and subject to our Australian Financial Services License (AFSL) Privacy Policy.